The Best Startup Pitch Deck Examples

Reid Hoffman has said, “An entrepreneur is someone who jumps off a cliff and builds a plane on the way down.” The right pitch deck shows investors you’ve already built the wings.

This guide will review some of the best Pitch Deck Examples used by top-performing entrepreneurs and investors. We’ll explore what makes them great and talk about how you can apply the lessons from each to your own pitch deck.

In my work with hundreds of Powderkeg founders, I’ve seen how the best decks don’t just win meetings… they accelerate funding on founder-friendly terms. So lets dive in.

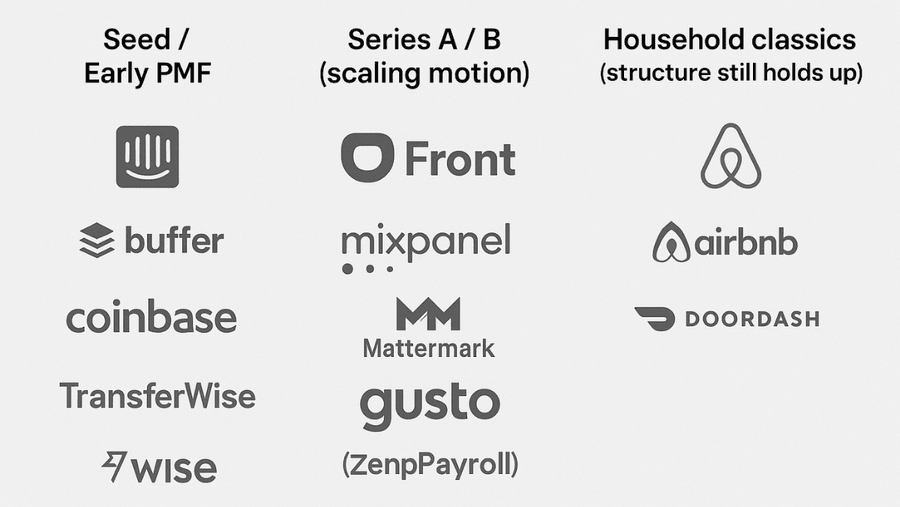

Seed Pitch Deck Examples

At the seed stage, your deck is often the only thing standing between your idea and a check. Y Combinator’s Paul Graham once advised founders to “make something people want” and your deck must prove you’ve done just that.

Intercom Pitch Deck (2012)

This ultra-lean 8-slide deck helped Intercom raise a $600k seed round. It’s praised for a crisp problem statement and story tailored to B2B SaaS messaging.

Buffer Pitch Deck (2011)

Known for transparency in early metrics, Buffer’s seed deck shared real revenue, churn, and growth figures, winning trust while raising ~$500k.

Coinbase Pitch Deck (2012)

Famous for making a complex category simple. It introduced Coinbase as an easy Bitcoin wallet and highlighted rapid early traction.

TransferWise Pitch Deck (2011)

This deck quantified the huge hidden fees in global transfers and showed how Wise’s peer-to-peer model could undercut banks, backed by strong early traction.

Series A Pitch Deck Examples (+ Growth Stage)

By the time you hit Series A, the stakes are higher and investors expect proof that your model works.

Bill Gurley once said, “The most common mistake startups make is raising money without a repeatable sales motion.” A great growth-stage deck demonstrates that repeatability: traction, retention, and efficient scaling. Within Powderkeg, we’ve seen members at this stage raise faster and on better terms by showing not just momentum, but a roadmap to scale with discipline.

-

Front Pitch Deck (2016) – Shared by CEO Mathilde Collin, this deck combined big vision with metrics like churn <3% and efficient ARR growth, raising a $10M Series A.

-

Mixpanel Pitch Deck (2014) – Used to raise $65M from Andreessen Horowitz. Notable for its data-rich slides on retention and product usage, selling growth through numbers.

-

Mattermark Pitch Deck (2014) – A clear pipeline + traction story. It showed $125K MRR with 377% YoY growth and positioned Mattermark as the “Google for business info.”

-

Gusto (ZenPayroll) Pitch Deck (2012) – Shared via Business Insider, this deck nailed the SMB SaaS clarity by explaining payroll pain, timing, and vision for expansion.

Classic Pitch Deck Examples

Some decks become the stuff of legend because they illustrate timeless principles of storytelling and persuasion. Airbnb, Dropbox, and DoorDash all used deceptively simple slides to spark investor imagination, and those decks are still teaching founders today.

As Marc Andreessen has noted, “In a startup, absolutely nothing happens unless you make it happen.” These classic pitch decks are reminders that a clear story and bold vision can make investors believe—and help you raise from the best, on your terms.

-

Airbnb Pitch Deck (2008) – The 10-slide masterclass in narrative flow, covering problem, solution, market size, business model, and traction in a clean story arc.

-

Dropbox Pitch Deck (2007) – Famous for brevity: “Storage is a mess” → “It just works.” This deck is a case study in delivering a clear value prop in one breath.

-

DoorDash Pitch Deck (2013) – Traction-first storytelling. Opened with 31% week-over-week growth in deliveries and the “Why now” (70% of the U.S. lacked delivery options).

Why do some startup pitch decks win over investors while others fall flat?

In today’s competitive fundraising landscape, a stellar pitch deck can make all the difference between securing capital or being overlooked. Venture capitalists see hundreds of startup pitch deck examples each year and spend only a few minutes on each on average.

In fact, studies show investors spend just ~3 minutes 44 seconds per deck, meaning your deck must grab attention fast. Yet only ~1% of pitch decks lead to funding, so you can’t afford a subpar presentation. Only about 1% of pitch decks succeed in getting funded. A tiny green slice represents the decks that secure investment, versus the vast majority that don’t.

Why Your Funding Pitch Deck Matters More Than Ever

Securing investor attention in 2025 is both an art and science. Global startup funding in 2023 plunged to its lowest level in 5 years : $285 billion, down 38% from 2022. Investors are more selective, doing fewer deals and demanding stronger evidence of traction and viability. Amid this tighter venture capital climate, your pitch deck is often your first impression and biggest differentiator. In fact, around 89% of VCs expect a pitch deck as part of any fundraising process. A weak deck can derail your chances before you even get to a meeting.

A great funding pitch deck does more than just describe your business – it sells your vision and instills confidence. It tells a compelling story of the problem you solve, how you’ll make money, and why your team is uniquely suited to execute. “Send me your deck” is usually the first thing an investor says, because it’s a quick way to size up your startup.

Too many founders focus only on the pitch and not enough on the relationship with investors. But your deck is the hook that can spark that relationship. It’s often shared internally at firms and passed around, sometimes without you in the room to add context. Thus, the deck must stand on its own and wow the reader.

So, why does your pitch deck matter so much right now? Because investors’ time and capital are more precious than ever. They will quickly filter out pitches that don’t resonate. On the flip side, a polished, story-driven deck signals that you are prepared, professional, and understand your market. It can separate you from the 99% of decks that fail to get funded. In short, your pitch deck is your startup’s ambassadors… make it count.

Key Elements of a Successful Investor Pitch Deck

To craft a winning pitch deck, it helps to follow proven frameworks. Venture firm Sequoia Capital famously outlined 10 key slides every startup deck should cover. Here are the essential sections your funding deck needs, in roughly the order you’d present them:

- Problem: What pain point or opportunity are you addressing? Make it relatable and significant. As Sequoia’s template suggests, clearly describe the customer’s pain and how they cope today. This sets the stage for why your startup matters.

- Solution: Your value proposition – how does your product/service solve the problem? Show how you make the customer’s life better. Keep it concise and tangible (e.g. demo screenshots or use cases).

- Market Opportunity: Who is your target customer and how big is the market? Investors want to see a large TAM (Total Addressable Market) if you capture even a fraction. Include data to validate that people want what you’re building.

- Product (or Tech): Briefly, what have you built and what is unique about it? If needed, outline your product roadmap or any proprietary tech/IP. Visuals or a quick product demo can be powerful here.

- Business Model: How will you make money? Lay out your revenue model, pricing, and go-to-market strategy. Be clear on who pays you and the economics (e.g. revenue per user).

- Traction: Any evidence of early success – users, revenue, growth metrics, partnerships, etc. Traction is king for investors. If you have impressive growth, show it early and boldly (sometimes even right after the intro). Traction “up and to the right” can overshadow other weaknesses.

- Team: Who are the founders and key team members, and why are they the right people to execute this vision? Highlight relevant experience, domain expertise, or previous startup successes. Remember the adage: investors bet on the jockey, not just the horse. A strong team can trump other shortcomings. (Tip: If you’re a first-time founder, showcase advisors or early hires who bring credibility.)

- Competition: A honest view of the competitive landscape and your differentiation. Smart founders list competitors and articulate their unique advantage. This shows you understand the market. Avoid saying “we have no competition” – that’s a red flag.

- Financials & Metrics: Especially for more mature startups, include a high-level financial forecast (3-5 year projections) and key metrics (CAC, LTV, margins, etc.). Surprisingly, 85% of decks miss financial projections – don’t be one of them. Investors want to see your revenue potential and unit economics. Even at early stage, a simple forecast and current burn rate runway is useful.

- The Ask & Use of Funds: Conclude with how much capital you’re raising and what it will be used for (e.g. product development, key hires, marketing). Also specify current status (e.g. already raised $X from angels, or seeking $Y for a 18-month runway). Make the ask clear so investors know the opportunity.

These ingredients form the backbone of most successful pitch decks. You can adjust the order and combine sections as needed (for example, “Market + Opportunity” could be one section). But ensure you cover the fundamentals above. Many founders also add an intro slide (with a one-line tagline of the business and contact info) and a closing slide (thank you + contact details). Don’t underestimate these – the first and last slides often linger the longest and should be memorable (include your email!).

Emphasize Traction, Team, and Market

While all sections are important, investors consistently say the three slides that matter most are Traction, Team, and Market. If you have great traction – for example, rapid user or revenue growth – lead with that, as it “forgives all other sins” in an early-stage company. Conversely, if traction is weak or pre-revenue, lean into the strength of your Team or the promise of a big Market.

Traction: Show any charts “up and to the right.” This could be monthly active users, revenue, customer retention, engagement – whatever best indicates momentum. For instance, if you’re growing 20%+ month over month, put that front and center. Traction is king. Investors know an early-stage startup with real usage or revenue has de-risked the concept significantly.

Team: If you have rockstar founders or industry experts, highlight their background. As TechCrunch notes, investors will line up if, say, a proven entrepreneur with past exits is pitching. Even if not, emphasize relevant experience (e.g. “10 years in fintech, ex-PayPal”) and that your team uniquely understands this problem. Show advisers or mentors if they add credibility. The team slide is one of the top 3 slides VCs scrutinize – investors ultimately invest in people.

Market: Demonstrate that you’re in a space that can get big or is trending hot. A huge or rapidly growing market can excite investors even if product is early. Use credible sources to size your market and explain your niche focus. For example, “We’re targeting a $10B SaaS market growing 20% YoY, starting with niche X before expanding.” If your market is currently small but you foresee explosive growth, tell that story. Investors love a rising tide (e.g. AI in 2023).

By prioritizing traction, team, and market in your narrative, you hit the points that funders care about most. Everything else (product, solution, etc.) is still needed, but often serves to support these main pillars.

Keep It Concise: The 10/20/30 Rule

When it comes to pitch decks, simplicity wins. Famed investor Guy Kawasaki advocates the 10/20/30 rule: 10 slides, 20 minutes, minimum 30-point font. This forces you to focus on the essentials. Many founders try to cram too much info into dense slides – a fatal mistake. Remember, your deck is a storytelling aid, not an encyclopedia.

- 10 Slides: If you can’t convey your business in 10 slides, you may not fully grasp the core narrative. (There are exceptions – some successful decks have ~12–15 slides – but 10 is a great target for clarity.) As Kawasaki quips, “If you need more than ten slides to explain your business, you probably don’t have a business.” Use backup appendix slides for extra data if needed, but keep the main deck tight. Notably, decks with ~11–20 slides tend to perform best in fundraising success rates, whereas overly long decks can be a red flag.

- 20 Minutes: Even if you’re allocated an hour meeting, plan to present your deck in ~20 minutes. Technical setups and Q&A often eat the rest. By presenting crisply in 20 minutes, you leave ample time for discussion – which is where investors really engage and drill down. Plus, brevity shows respect for everyone’s time. It’s wise to practice a 5-10 minute version of your pitch as well, since some pitch competitions or initial calls are very short.

- 30-Point Font: This essentially means keep text minimal. A good rule: no slide should have more than 3-5 bullet points or 40 words. Use large font for readability and to force yourself to hone the message. Small fonts lead to info-dump slides that you’ll be tempted to read verbatim (and yes, investors will read ahead of you). Use visuals wherever possible instead of text – charts, images, icons – since our brains process visuals faster (and decks with visuals are 43% more persuasive than text-heavy ones).

Sticking to these guidelines keeps your deck lean and impactful. As the saying goes, “If I had more time, I would have written a shorter letter.” It takes effort to cut the fluff, but it pays off. Your goal is a pitch deck that can be understood in a quick skim, sparks interest, and opens the door to deeper conversations. In the next section, we’ll see how these principles come alive in real-world examples of successful decks.

10 More Pitch Deck Examples and Breakdowns (and Lessons to Steal)

One of the best ways to learn how to craft your pitch deck is to study successful startup pitch deck examples. Below, we explore ten famous (and diverse) pitch decks from startups that raised funding. For each, we’ll note what stood out and key takeaways you can apply. These examples range from scrappy seed rounds to massive later-stage raises, giving you a flavor of different styles and approaches.

1. Airbnb Pitch Deck:

The $500K Seed Pitch Deck that Became a Template

Arguably one of the most famous startup pitch decks, Airbnb’s original 2009 deck has become a go-to reference for founders worldwide. This simple 10-slide deck helped Airbnb raise $500,000 in an angel seed round (Airbnb’s founders famously maxed out credit cards until securing this funding).

The simplicity and clarity of the deck are its standout features. The opening tagline slide distilled the idea perfectly: “Book rooms with locals, not hotels.” The deck outlined the problem (expensive, impersonal hotel stays), Airbnb’s solution, market validation, business model, and early traction (impressive booking rates during events). Each slide was very straightforward:minimal text, big visuals.

Outcome: Airbnb used this deck to win over investors like Sequoia Capital, and today it’s often cited as a pitch deck template for startups.

Key takeaway: Don’t overcomplicate. Airbnb’s deck shows the power of a clear value proposition and storytelling. Even without significant financials (at the time), the deck conveyed a bold vision in a highly digestible format, which is why it’s one of the best pitch deck examples to emulate.

(Fun fact: Universities now teach the Airbnb deck in business schools as an example of a successful pitch.)

2. Uber Pitch Deck

25 Slides for a $1.3M Seed Round (UberCab’s First Deck)

When Uber (then “UberCab”) was raising its seed round in 2008, co-founder Garrett Camp put together a 25-slide pitch deck – longer than typical, but it covered a lot of ground for this new concept. The Uber pitch deck example walked through the vision of an “on-demand black car service” in cities, the problems of traditional taxis, and how UberCab’s app worked. It also outlined expansion plans beyond cars.

Uber’s deck emphasized market size and the opportunity to disrupt transportation. The approach worked: Uber raised about $1.3 million in seed funding with that deck. Lesson: It’s okay to use more slides if needed to tell a complete story (especially for a novel concept), but ensure each slide has a purpose. Uber’s early deck wasn’t flashy in design, but it methodically answered investors’ questions about market, model, and vision of scale. As a result, it set the foundation for what would become one of the biggest startups ever.

3. YouTube Pitch Deck

A 10-Slide Series A Deck that Raised $3.5M

YouTube’s 2005 pitch deck is a classic Series A pitch deck example. The deck (just about 10 slides) was used to pitch Sequoia Capital and other VCs, ultimately securing $3.5 million in Series A funding. At the time, YouTube had under 10,000 users – tiny, but the deck sold a big vision of a new online video community. Key slides included the problem (difficulty sharing videos online), YouTube’s simple solution, strong early engagement metrics, and how the service could scale and monetize (through ads and partnerships). One notable aspect: despite limited revenue, the deck highlighted user growth and time-on-site to prove traction. Lesson: If you’re pre-revenue or pre-monetization, focus on user engagement and growth metrics to show traction. YouTube’s investors were sold on its rapid uptake and the huge market of online video, even before solid revenue – because the deck made a convincing case that once scale was achieved, monetization would follow (they were right!). This example also reinforces keeping it brief; you don’t need 30 slides to convey a breakout growth story.

4. Facebook Pitch Deck

Leveraging Metrics When Revenue Was Zero

When Facebook (then “TheFacebook”) went out for early funding around 2004, it didn’t have revenue yet – but it had explosive user growth on college campuses. Facebook’s early pitch deck (technically more of a media kit) focused on engagement and the network’s growth, since that was its strongest asset. The deck shared stats like number of users at various universities, daily usage time, and a bold vision of connecting the world’s students. It addressed the “how will you make money?” question by outlining future plans for advertising and premium services, but the real emphasis was on becoming the dominant social network (which was already evident in their metrics). This deck helped Facebook secure funding (e.g. the $500K from Peter Thiel and later venture rounds).

Lesson: Know your strengths and lead with them. In Facebook’s case, it was user base and engagement – the deck screamed “huge network effect” even though monetization would come later. If your startup’s value lies in users or technology or patents, make that the star of your pitch. Also, use data points as proof wherever possible. Facebook’s metrics gave investors concrete evidence of traction in lieu of revenue.

5. LinkedIn Pitch Deck

A B2B Social Network Pitch for $10M (Series B)

Not all great pitch decks are for consumer apps – LinkedIn’s Series B deck is a pitch deck example for B2B/social businesses that had a more professional tone. Reid Hoffman and team raised $10 million in 2004 (Series B) from Greylock Partners.

The deck highlighted how LinkedIn was gaining users among professionals and becoming a recruiting/job networking platform. A key slide broke down LinkedIn’s user growth and engagement among business users, differentiating it from then-dominant MySpace/Facebook (consumer-focused). The business model slides showed plans for premium subscriptions and recruitment tools – convincing investors that revenue streams were in place (indeed LinkedIn would later thrive on recruiting revenue).

Lesson: For more mature or B2B startups, your deck may dive deeper into monetization and unit economics. LinkedIn’s deck balanced user growth with a clear path to revenue (ads, subscriptions). It also likely included slides on corporate partnerships and the team’s experience (Hoffman had a strong PayPal Mafia pedigree). The takeaway here is to tailor your pitch to your audience: LinkedIn pitched a more conservative VC audience at Greylock, so the deck was data-rich and strategy-focused. If your startup is targeting enterprise or B2B investors, ensure your deck speaks their language (less hype, more business case). LinkedIn’s success shows that a solid, data-driven story can raise big funds even in nascent markets.

6. Dropbox Pitch Deck

From $15K Seed to $16B IPO (Tiny Deck, Huge Vision)

Dropbox’s early pitch deck is often mentioned because it started so humbly. Dropbox received its first seed funding (reportedly as low as $15,000 from Y Combinator) with a simple demo and deck, yet grew into a $16.8 billion company. The Dropbox pitch deck (circa 2007) was very product-centric – it demonstrated how seamlessly Dropbox synced files across devices (including a live demo that wowed people).

The slides themselves focused on the pain point (file access across devices) and how existing solutions were clunky. Dropbox’s solution slide was basically screenshots of the product in action. There was a slide for market size (huge, basically “any computer user”) and one for their freemium model (free accounts to hook users, then upsell to paid storage). They also smartly addressed “competitors” by noting big companies hadn’t solved this simple problem well yet.

Lesson: If you can demo your product or include a short product video/GIF in your deck, do it. Dropbox’s visual demo was incredibly persuasive – sometimes showing is better than telling. Also, this example highlights the power of a focused use-case. Dropbox didn’t try to be everything; it solved one problem really well, and the deck drove that home. For founders, Dropbox’s story is inspiring: even a very small initial round (friends & family or accelerator level) can scale if your vision and execution are strong. Keep your deck product-focused and user-focused if that’s your strength, and investors who experience the “aha!” moment will buy in.

7. Buffer Pitch Deck

Transparency and Traction for a $500K Seed

Buffer, a social media SaaS tool, is known for publicly sharing its pitch deck that raised $500,000 in seed funding. Co-founder Joel Gascoigne blogged about his fundraising and even posted the deck online – making Buffer a rare case of full transparency. The Buffer pitch deck was relatively short and notable for its clarity of traction. It included real numbers: monthly recurring revenue growth, number of paying customers, and cost of customer acquisition – all very appealing for a SaaS at seed stage. Buffer also outlined how it would use the funds to scale marketing and product. The design was clean and the messaging straightforward (“Buffer makes it easy to schedule social media posts, used by X thousand users”).

Lesson: Especially for SaaS startups, include your key metrics (MRR, growth rate, CAC, LTV, churn) early. Investors appreciate when founders know their numbers. Buffer’s openness likely built trust with investors – it showed confidence in their metrics. Another takeaway is the value of social proof: Buffer’s deck mentioned the user base and even names of known brands using the product, leveraging credibility. This example reinforces that you don’t need an over-hyped style; a factual, numbers-driven pitch deck that “shows the receipts” of traction can be incredibly persuasive to investors.

8. Peloton Pitch Deck

$500M Series F Deck (Fitness Unicorn Story)

Not every pitch deck example is for early-stage companies – later-stage fundraising has decks too, often focusing on scale and vision. Peloton, the connected fitness company, raised a massive $500 million Series F round in 2018, and reportedly their pitch materials doubled down on their growth and future plans. By that time, Peloton had significant revenues, so their deck emphasized market dominance and expansion. It likely included impressive metrics: subscriber growth, low churn, high engagement of users (e.g. number of workouts per month), and the ecosystem of hardware, software, and content they built. Importantly, Peloton’s deck painted a “future of fitness” vision where every living room could be a boutique studio – appealing to investors’ imagination of a huge market.

Lesson: In late-stage decks, financials and metrics take center stage. You’ll be presenting CAGR, unit economics, and perhaps scenarios for IPO. But even then, don’t lose the storytelling – Peloton sold a story of revolutionizing an industry, which supported its huge valuation. For earlier-stage founders, looking at a unicorn’s deck can inspire how to articulate a grand vision: Peloton wasn’t just selling exercise bikes, it was selling the idea of a new fitness paradigm (community + convenience). No matter stage, sell the vision, not just the product.

9. Mint.com Pitch Deck

Fintech Pitch Deck (Pre-launch to Acquisition)

Mint.com, a personal finance app, created a legendary pre-launch pitch deck that helped it win the TechCrunch Disrupt startup competition and attract VC funding, ultimately leading to a $170M acquisition by Intuit. The Mint pitch deck example is often cited for its crisp visuals and storytelling. It opens with a bold claim about simplifying personal finance, shows a demo-like walkthrough of the app’s UI, and uses graphics (like pie charts) to illustrate how Mint tracks your finances. One slide that stood out was the competition slide – Mint used a quadrant graph to position itself apart from other finance tools, making it clear why it was different. The deck also outlined a clever customer acquisition strategy (content marketing via personal finance blogs, which Mint executed brilliantly).

Lesson: Design and visual communication can elevate a pitch deck. Mint’s deck wasn’t text-heavy; it relied on imagery to make an impact (fitting for a consumer app). Founders should ensure their deck is visually appealing – use charts and infographics to convey numbers (Mint did this to show market size and user pain points. Additionally, a smart go-to-market slide can set you apart: Mint impressed investors with its plan to cheaply acquire users via SEO/content, turning a usually boring slide into a highlight. Mint.com’s example shows a well-designed deck with a strong marketing story can win investor confidence even before product launch.

10. Sequoia Pitch Deck Example Template

Sequoia Capital’s 10-Slide Template – The Investor’s Perspective (Bonus Example)

Our final example isn’t a single startup’s deck but rather a framework that has influenced countless decks: Sequoia Capital’s recommended 10-slide pitch deck template[7]. Sequoia is a top VC firm, and years ago they published a guide (often referenced in Slideshare form) detailing exactly what they like to see in a deck: Company Purpose, Problem, Solution, Why Now, Market Size, Product, Team, Business Model, Competition, Financials.

Many founders have used this outline to build their own decks. If you see a commonality across the examples above, it’s because most hit all these points. Sequoia’s template is essentially a distillation of the key elements we discussed earlier.

Why include this here? Because understanding the investor’s mental checklist is critical. An investor reviewing your deck is subconsciously ticking off: Have they clearly stated the problem? Solution? Market size? etc. Sequoia’s format ensures you answer the fundamental questions in a logical flow.

Lesson: You can do something innovative or creative in your deck, but don’t neglect the basics that sophisticated investors expect to see. By covering the ten areas Sequoia highlights, you increase your chances that your deck resonates. Think of it as an implicit checklist every VC might have. In short, know the rules before you break them. This template is a great starting point to ensure you hit all the high notes of an investor pitch.

These ten examples offer a treasure trove of insights. From them, you should notice some recurring themes: clarity of purpose, focus on traction, knowing your audience, and telling a big story backed by data. There’s no single “perfect” way to craft a pitch deck – it should reflect your company’s unique story – but studying successful decks helps you model what works and avoid pitfalls.

Pro Tips to Create Your Own Winning Pitch Deck

Now that you’re inspired by real-world examples, let’s distill some actionable tips for crafting your pitch deck. Keep these best practices in mind as you build your slides:

- Tell a Story: Don’t just present facts – weave them into a narrative. Set up the problem and resolution like a story arc. Many great decks follow a storyline (Problem → Solution → Success/vision) that makes the pitch memorable. Use your customer’s story or a relatable scenario to draw investors in emotionally at the start. Storytelling is especially powerful for awareness-stage readers who may not be familiar with your space, as it educates while building interest.

- Focus on Benefits, Not Features: Whether describing your product or traction, emphasize why it matters. For example, instead of “Our app has machine-learning algorithms,” say “Our app predicts and saves customers money using machine learning.” Tie everything back to value creation. Investors need to envision the impact of your solution.

- Design for Readability: A clean, visually appealing deck can set you apart (it signals professionalism). Use consistent fonts, brand colors, and high-quality graphics. Break up text with visuals. Charts, graphs, or icons can convey a point faster than a paragraph. For instance, if claiming “fast growth,” show a simple chart of your user curve. If you’re not design-savvy, consider using templates or hiring a designer – it’s often worth it.

- Leverage Social Proof: If you have any credible validation, include it. This could be customer testimonials, logos of paying clients, letters of intent, partnerships, or accolades/awards. For example, if TechCrunch or Forbes mentioned your startup, add a “Featured in Forbes” snippet. Or if you have well-known investors/advisors already, name-drop them (with permission). Social proof builds trust, which is crucial for investors who are essentially betting on an unknown venture.

- Be Honest About Challenges: A sophisticated investor will appreciate candor. If there’s a known hurdle (e.g. a regulatory approval needed, or a strong competitor), it’s often better to acknowledge it in your deck or conversation rather than pretend it doesn’t exist. Then explain why you can overcome it (your strategy or unique edge). This demonstrates integrity and strategic thinking. As one VC advice goes, “Don’t ever say you have no competitors – if you think that, you haven’t looked hard enough.”

Common Pitch Deck Mistakes to Avoid

It’s just as important to know what not to do. Here are some frequent pitch deck pitfalls that founders should steer clear of:

- Too Much Text / Info-Dump Slides: One entrepreneur who reviewed dozens of decks found “too wordy” slides in 74 out of 82 decks. Cramming your slides with paragraphs or an army of bullet points will lose your audience. Investors don’t read long blocks of text – they’ll tune out. Stick to one main idea per slide. Use a big font as a self-enforcing constraint. If you have lots of details (e.g. technical specs or detailed financials), put them in an appendix or provide in a follow-up, not in the core deck.

- Missing Critical Slides (like Financials): Astonishingly, 85% of decks reviewed in one study lacked a financial projections slide. Investors will ask about your revenue model and runway – failing to include this invites doubt. Even if your numbers are rough estimates, it’s better to show you have a plan for monetization and understand your cash needs. Always include a slide on how you make or will make money, and basic projections (even if just “expected revenue in 2 years” or unit economics). If you’re pre-revenue, showcase user growth or pipeline and state assumptions for future revenues.

- Cluttered, Hard-to-Follow Slides: Slides that try to do too much – tiny fonts, charts crammed with data, jargon everywhere – will confuse and irritate viewers. As one reviewer put it, “A cluttered slide equals a cluttered mind. SIMPLIFY.” Make sure each slide has breathing room. Use clear headings and visuals. Avoid jargon or technical acronyms that a general investor wouldn’t immediately know. Your deck should be easily understood by someone who isn’t an expert in your field. Save the detailed deep-dives for later discussions or appendices.

- No Contact or Follow-Up Info: Believe it or not, many founders forget to put their contact details on the deck. In one analysis, 62 of 82 decks lacked sufficient contact info on the slides. Always have an intro or final slide with your email/phone and perhaps your LinkedIn handle. If your deck gets forwarded (which is common), you want interested parties to easily reach you. Also consider including a short “Team & Contact” slide early on or at the end, listing the founders and an email. Don’t make investors go on a scavenger hunt to find you.

- Unclear Business Model: Investors shouldn’t be left wondering “So, how will you actually make money?” A common mistake is dancing around the business model or stating something too vague like “we’ll monetize via ads” without details. If it’s not obvious, include a slide to spell out pricing, cost structure, and revenue streams. For example: “We offer a SaaS subscription at $100/mo per company, with an upsell for premium analytics. Gross margin ~80%.” That gives a concrete sense of your economics. If investors can’t figure out how your beautiful product becomes a viable business, they won’t fund it.

- Ignoring the Ask: Don’t forget to clearly state how much you’re raising and what the terms are (if you have a lead or a valuation in mind, etc.). Many decks leave out the ask, forcing investors to guess how much capital is needed. Be upfront: “Seeking $2M seed round to extend 18-month runway, primarily for product development and key hires in sales.” This frames the conversation toward next steps. Also, be sure your ask matches your plan – e.g. don’t say you’ll conquer a huge market on just $200k; conversely, don’t ask for $10M if you’re pre-product, as it will seem unrealistic. Align the fundraising to milestones.

By avoiding these mistakes, you dramatically improve your deck’s effectiveness. It can be helpful to have a mentor or fellow founder review your deck specifically to catch these pitfalls. (In the Powderkeg community, for instance, founders often share pitch decks with advisors or investors for feedback – a great practice to refine your message.)

Next Steps: Refine, Practice, and Pitch with your Pitch Deck

Creating a standout funding pitch deck is a journey. You’ve laid the foundation by understanding what investors look for and seeing examples of success. Here’s what to do next:

- Draft your deck using the frameworks and tips above. Aim for ~10-15 slides covering Problem, Solution, Market, Team, Traction, etc. Start with an outline, then fill in content. Use the high-priority keywords (like “pitch deck”!) naturally as you describe your business – this isn’t just good for SEO if you publish your deck, but also reinforces to investors that you know the lingo.

- Get feedback and iterate. Don’t create in a vacuum. Share your draft deck with trusted mentors, fellow entrepreneurs, or investors you have relationships with. Incorporate their feedback to improve clarity and impact. (Is anything confusing? Are they left with unanswered questions?) Many successful decks went through dozens of iterations.

- Use resources and templates. You don’t have to start from scratch on design – there are many pitch deck templates (some free, some paid) that follow the best practices. For example, tools like Canva and Pitch offer pitch deck presentation templates. Just be sure to customize and not come off as too generic.

- Practice your verbal pitch alongside the deck. Remember, the deck is not a teleprompter – avoid reading bullets verbatim. Instead, know the story of each slide and practice the narration. Time yourself to keep within 20 minutes. The more you practice, the more confident and natural you’ll be when delivering to real investors. As one founder advises: “Know your pitch upside down and inside out. Practice until you can do it in your sleep.”

- Plan for Q&A. A great deck will spur questions – be ready to dive deeper on any aspect of your business. Prepare backup slides or at least have data at your fingertips for things like detailed financials, go-to-market plans, technical specs, etc. Being over-prepared for questions will both calm your nerves and impress investors with your grasp of the business.

Finally, always be refining. A pitch deck is a living document. As your startup evolves (new traction, product changes, etc.), update your deck accordingly. Customize it if needed for different audiences (perhaps a slightly different version for VCs vs. angel investors or strategic partners). And remember, the deck’s goal is to get you to the next meeting – not to secure the investment on the spot. So focus on piquing interest and demonstrating opportunity. The deeper diligence and deal-making comes after you’ve wowed them with your initial pitch.

Pitch Deck Examples: Frequently Asked Questions

Q: What should a funding pitch deck include?

A: A winning funding pitch deck should include 8-10 essential sections: an attention-grabbing overview or tagline, the problem you’re solving, your solution (product/service), the market size/opportunity with data, your business model (how you make money), any traction or key metrics so far, your team background, the competitive landscape (competition and your edge), and basic financials/projections. Don’t forget a closing slide with your “ask” (how much you’re raising) and contact info. This aligns with the classic Sequoia 10-slide template covering company purpose, problem, solution, why now, market, team, etc.

Q: How long should an investor pitch deck be (in slides and time)?

A: Aim for around 10 to 15 slides for the main presentation. This length forces you to focus on the key points without overwhelming investors. In terms of time, plan to present the deck in roughly 20 minutes or less. This is part of the 10/20/30 rule – 10 slides, 20 minutes, 30-point font – popularized by Guy Kawasaki to keep pitches concise. You may have additional backup slides for Q&A, but the core deck should be tight. Remember, investors often decide within the first few minutes if they’re interested, so less is more. If you have a demo, factor that into your time as well (e.g. a 15-minute talk + 5-minute demo fits in 20 minutes).

Q: Do I really need financial projections in an early-stage pitch deck?

A: Yes – at least at a basic level. Even for pre-revenue startups, investors want to see that you have a business case and have thought through the economics. Include a simple projections slide showing 2-3 years out (you can use a chart or key numbers table). It doesn’t need to be extremely detailed, but should cover expected revenue, costs, and cash burn relative to the raise. Also outline how you’ll use the funds (use of proceeds). Omitting financials is a red flag – one analysis noted 85% of decks lacked projections, which can be a mistake.Having a forecast, even if it’s based on assumptions, shows you’re planning for growth and understand your runway.

Q: Where can I find other examples of pitch decks?

A: There are many places to find real pitch deck examples. A few tips:

– Articles & Databases: Websites like Slidebean, PitchDeckHunt, and BestPitchDeck.com compile famous startup decks (Airbnb, Uber, LinkedIn, etc.) with commentary. Also, some VC firms (Sequoia, Y Combinator) have published example decks or templates.

– Slideshare: A lot of startup pitch decks have been uploaded to Slideshare. Searching for “[Startup Name] pitch deck Slideshare” can often yield the original slides (e.g. Airbnb, Buffer, LinkedIn’s decks are on there).

– Founder blogs: Some founders share their decks in blog posts (Buffer and Mattermark are examples that published their seed decks openly). Searching “[Startup] pitch deck PDF” can lead to these.

– Powderkeg and Communities: Startup communities (like Powderkeg, Y Combinator forums, etc.) sometimes share anonymized decks or have galleries of past pitch competition winners. Attending pitch events or demo days is another way to see decks in action.

Studying these examples (like the ones we covered in this guide) is smart – just remember to tailor your own deck to your story and not copy blindly.

Q: How can I make my pitch deck stand out to investors?

A: A few strategies to stand out:

1) Start with a strong hook (e.g. a surprising statistic or a powerful one-liner that piques curiosity).

2) Emphasize what’s most impressive about your startup upfront. If you have 100K users or 20% month-over-month growth, show that early and visibly (investors perk up at traction).

3) Use visuals and design to your advantage. A clean, graphically engaging deck is a pleasure to read compared to a text-dense one. Consider including a short product demo video or GIF in the deck if possible (product sparkle can leave an impression).

4) Highlight your unique insight or secret sauce. Something that shows you have an edge (tech, data, expertise, patent, etc.).

5) Be data-driven and specific. Vague claims like “we will go viral” or “potential to make millions” are less convincing than concrete data or targets.

6) Lastly, show enthusiasm and vision. A deck with a bland tone won’t excite anyone. Investors often invest in the founder’s passion and vision, so make sure that comes across in your slides and presentation. Storytelling, as mentioned, will make your deck more memorable. Combine a compelling narrative with evidence, and you’ll stand out in a stack of decks.

Q: What if I don’t have much traction yet? How can I persuade investors with my deck?

A: If you’re very early and lack significant traction (revenue or users), focus on what you do have and the future potential:

– Team & Background: Emphasize your team’s strengths and why you’re uniquely qualified to solve this problem (e.g. domain expertise, previous startup experience, great technical talent, etc.). Investors might bet on an A+ team tackling a B idea, rather than vice versa.

– Market Pain & Solution: Clearly illustrate the problem with data or anecdotes. If the pain point is acute and you show a compelling solution prototype or MVP, that can carry weight. Maybe you have letters of intent or a waitlist – that’s early validation.

– Prototype or Demo: If possible, include screenshots of your prototype or do a quick demo during the pitch. Seeing even a rough product is more convincing than ideas on paper.

– Strategy: Lay out a credible go-to-market plan. Show you’ve talked to customers and understand how you’ll acquire users/customers (even if product isn’t launched). Any signals of demand – like survey results, pilot program MOUs, or even small pre-sales – can act as proxy traction.

– Vision and Roadmap: Paint the picture of what early traction will look like in 6-12 months if funded. For instance, “with this funding, we plan to launch by Q4 and reach 10K users within 6 months by partnering with X.” Essentially, you’re asking investors to believe in the future traction.

Also, acknowledge the risk (no traction yet) but frame it as an opportunity – “we’ve accomplished X with limited resources, and with your investment we will hit Y milestones.” Many investors invest pre-traction if the story, market, and team are promising enough.

Your deck just needs to make a compelling case for potential, using whatever evidence you can gather (market research, strong prototype, etc.). And don’t be discouraged… remember that even companies like Facebook and YouTube raised money pre-revenue by showcasing user growth and vision, which your deck can do as well.

Ready to craft your ultimate pitch deck and share your startup’s story?

Don’t go it alone. Tap into resources like Powderkeg’s community, where you can get feedback from experienced entrepreneurs and even connect with potential investors. If you’re a tech founder looking to level up, consider joining Powderkeg Executive Councils, our private network of tech executives and founders. It’s a place to workshop things like pitch decks, access mentors, and open doors to funding opportunities. We’ve helped hundreds of entrepreneurs refine their pitch and accelerate their growth. You can also keep an eye out for Powderkeg pitch events (both virtual and in tech hubs) where you might test drive your deck in front of friendly audiences before going to Sand Hill Road.

Your pitch deck is often the first step to your next big milestone – investment, new partners, maybe even that unicorn status down the road. Make it count, keep learning from each pitch, and don’t be discouraged by “no’s” (they’re part of the journey). With the guidance from this guide and a standout deck in hand, you’ll be well on your way to turning investor interest into a term sheet. Good luck, and happy pitching!